Over 60? This Bedtime Stretch Routine May Ease Stiff Joints

This bedtime stretch routine helps ease stiff joints for seniors, promoting flexibility and better sleep for a healthier lifestyle.

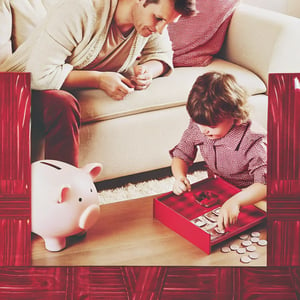

Learn key money skills to make smart decisions

Discover why parenting daughters may be more stressful, including insights on societal expectations and coping strategies for parents.

Explore how common spices like turmeric and garlic may support cancer prevention through their antioxidant and anti-inflammatory properties.

Explore hypoparathyroidism, its symptoms, causes, and effective treatment options for proper management of this rare endocrine disorder.

Discover how to find affordable legal help for divorce cases through legal aid, pro bono services, and community clinics.

Explore pilot training scholarships in Dubai for 2026, making aviation careers more accessible through financial aid and diverse opportunities.

Explore the benefits and risks of rent-to-own homes, a flexible option for buyers looking towards homeownership without immediate commitment.

Discover 5 simple breakfast tweaks to lower creatinine levels and enhance kidney health through smart food choices and cooking methods.

Learn how to check if your prescription is eligible for lower prices and access more affordable medication through various resources.

Discover the causes, symptoms, and treatment options for Chronic Demyelinating Polyneuropathy to enhance understanding and quality of life.

Recognize migraine symptoms and early signs for better management. Learn about triggers and prevention tips to reduce debilitating attacks.

Explore the causes of sudden memory loss in adults, including medical, psychological, and lifestyle factors, and learn when to seek help.

Learn how to handle medical malpractice claims effectively with our comprehensive guide. Understand your rights, the claim process, and more.

Discover how diabetes watches are revolutionizing blood sugar monitoring with real-time data, flexibility, and user-friendly technology for better management.

Explore the differences between Levodopa and Ongentys in treating Parkinson's disease and find the best option for symptom management.

Discover how US small businesses can navigate the challenges of 2025 with innovative strategies for cash flow, workforce, and global trade dynamics.

Discover the 5 rapidly rising online scams of 2025. Learn how to spot and avoid these threats to protect your finances. Stay safe online!

Discover 13 effective litter box habits that keep your home smelling fresh and your pets happy. Control odors and maintain a clean environment.

Discover a new pill that may replace long-term blood thinners for AFib, improving treatment options and patient outcomes in heart health.

Explore five unsettling vintage photos that evoke eerie nostalgia, revealing the haunting stories behind each captivating image.

Discover the key features and updates of the 2026 Toyota Tundra, enhancing fuel efficiency, towing, and luxury for full-size truck enthusiasts.

Discover essential balance exercises and home safety tips that can help prevent falls and enhance stability for older adults.

Discover groundbreaking results on new medication Zepbound for treating sleep apnea, especially beneficial for those with obesity. Learn more inside.

Discover natural ways to lower protein levels in urine and improve kidney health through diet, exercise, and herbal remedies.

Discover the upgrades and features of the 2026 Ford F-250 Super Duty, designed for powerful performance and modern technology.

Discover how to spot valuable old pennies before they're gone. Learn about rare mint years, significant features, and tips for preservation.

Discover trending items in online selling, from home décor to tech gadgets, and learn how to succeed in the evolving digital marketplace.

CMS outlines its plan for the Inflation Rebate Program in 2025, targeting 64 prescription drugs to reduce costs for Medicare beneficiaries.

Discover new ways to manage AFib, understand its risks, and learn about innovative treatments like Pulsed Field Ablation for better heart health.

CMS announces 64 prescription drugs will receive inflation rebates this fall, easing financial burdens on Medicare beneficiaries under new legislation.

High protein in urine often signals kidney issues. Learn about causes, diagnosis, and how to protect your kidney health effectively.

Discover innovative diabetes care approaches for 2025 based on insights from endocrinologists, focusing on technology and patient empowerment.

Tired after 55? Discover why fatigue isn’t just age-related and learn about helpful tests that might explain everything.

Discover must-have Halloween decorations and why shopping early guarantees the best selection for your spooky celebrations this October.

Explore how modern medication storage enhances health management, improves patient care, and integrates with technology for better outcomes.

Discover why shoppers are buying holiday decorations early, from consumer behavior to retail strategies shaping this festive trend.

The 2026 Ford F-150 debuts with bold design, advanced features, and powerful engine options, setting a new standard for pickup trucks.

Explore the 2025 Toyota Camry's stylish design, hybrid efficiency, and impressive performance that drivers rave about in this comprehensive review.

Discover how innovative laser skin treatments are transforming skincare with precise results. Learn about popular options & benefits here.

Discover the rising trend of early holiday shopping and how retailers can adapt their strategies to capture consumer interest ahead of Christmas.

Discover why black heels have a profound impact on everyone, exploring their evolution, styling tips, and personal stories.

Discover phones with simple menus that enhance user experience for minimalism and ease of use, perfect for seniors and tech-savvy individuals.

Discover why deep navy blue is the trending front door color, enhancing curb appeal with timeless elegance and versatility for any home.

Discover the front door colors trending in 2025, from bold hues to modern neutrals that enhance curb appeal and showcase personal style.

Discover why women over 50 are embracing timeless wedding looks, blending elegance with modern style for their special day.

Viewers over 50 are increasingly drawn to sophisticated streaming content with complex storytelling and relatable characters, such as "The Crown", "Ted Lasso", and "Grace and Frankie", as streaming platforms recognize the purchasing power of this demographic. These shows offer not just entertainment but also opportunities for connection across generations, creating a streaming revolution for mature audiences seeking meaningful narratives and reflection of real-life experiences.

In 2025, the skincare industry has introduced innovative formulations for aging skin, focusing on hydration, barrier repair, and cellular regeneration with standout products like CeraVe Moisturizing Cream and La Roche-Posay's Lipikar Balm AP+. Key ingredients such as ceramides, hyaluronic acid, and niacinamide address dryness and inflammation, while emerging trends like microbiome-supporting and sustainable formulations are shaping the future of mature skin care.

Continuous glucose monitoring (CGM) systems offer a significant advancement in tracking glucose levels by providing continuous data and personalized insights, essential for diabetes management and broader metabolic health optimization, yet they can be expensive without insurance coverage. Integrating CGMs with other health monitoring devices can enhance understanding of individual metabolic responses, but users should consider accuracy, cost, and insurance options when selecting a device.

When looking to purchase noise-cancelling headphones, consider factors such as noise cancellation capability, comfort for extended use, and whether over-ear or in-ear styles suit your lifestyle, with premium models like Sony WH-1000XM5 and Bose QuietComfort Ultra offering top-tier performance. For finding deals, monitor major sales events and price tracking sites to capitalize on discounts, ensuring your investment in these headphones enhances productivity and provides superior audio quality.

To create a smart home theater, prioritize investing in a high-resolution smart TV and a quality audio setup, considering factors like size, display technology, and speaker configuration. Begin with a good display, then gradually expand by adding sound systems and smart integrations, balancing budget and performance, and leverage streaming services and physical media for optimal content quality.

The 2025 Nissan Murano offers a significant upgrade with a redesigned exterior and interior, improved powertrain options including a hybrid, advanced technology features like a 12.3-inch touchscreen and digital cockpit, and enhanced safety systems, all while maintaining competitive pricing starting at around $38,500, making it a strong contender in the mid-size crossover SUV market.

Portable solar power banks offer an eco-friendly solution to charge devices off-grid, particularly during camping, power outages, or for reducing your carbon footprint; they are best suited for small devices, varying in effectiveness based on sunlight conditions, with prices ranging from $20-$200 depending on capacity and features. Although they are not replacements for traditional power sources, investing in one can pay off over time through savings on disposable batteries and electricity for frequent users, despite lacking financial incentives like home solar installations.

Innovative oral appliances are transforming sleep apnea treatment by offering a comfortable and effective alternative to traditional CPAP machines, achieving a 79% success rate in reducing apnea events and improving compliance rates due to advancements such as precision digital fitting and real-time monitoring. These devices, costing $1,500 to $3,000, may be partially covered by insurance, particularly for patients with mild to moderate obstructive sleep apnea, and must be obtained and fitted through professional consultation following a sleep study.

Netflix is planning to invest over $17 billion in new programming for 2025, highlighting upcoming releases such as the next "Bridgerton" installment and the final season of "Stranger Things," while current top shows include "Squid Game," "Stranger Things," and "Money Heist."

Engaging in hobbies can positively impact mental health by interrupting negative thought patterns and boosting mood through the release of dopamine and serotonin, serving as a healthy complement to professional depression treatment. Activities such as creative pursuits, light physical movement, and meaningful hobbies provide both distraction and a sense of accomplishment, helping individuals manage depressive symptoms through consistent, small actions.

While this article mainly focuses on symptoms and treatment options for depression, it indirectly highlights the financial concern of ensuring access to mental health resources, such as consulting healthcare providers or therapists, and potentially affording medication and supportive care networks, underscoring the need to financially plan for comprehensive health care coverage.

To choose the best lotion for aging skin, focus on hydration and barrier repair by selecting products with ceramides, hyaluronic acid, and glycerin for 70-year-olds, and include soothing ingredients like colloidal oatmeal and shea butter for those in their 80s. Incorporate anti-aging ingredients such as retinol, peptides, and antioxidants to address firmness and tone, and maintain a routine with gentle cleansing, consistent moisturization, and sun protection.

The summary highlights strategies for indulging in sweet treats without compromising health goals, emphasizing smart snacking through options like dried fruits, dark chocolate-covered nuts, and sugar-free candies made with healthier sweeteners. It stresses the importance of portion control, mindfulness, and select options compatible with various dietary needs, reminding readers that balance and enjoyment can coexist in a healthy lifestyle.

The article provides a top five ranking of chocolate bars favored by true chocolate aficionados for their quality ingredients, complex flavors, and superior textures, featuring Valrhona Caraïbe, Tony's Chocolonely Dark Milk Chocolate Pretzel Toffee, Lindt Excellence Touch of Sea Salt, Ritter Sport Whole Hazelnuts, and Green & Black's Organic Dark 70%, while also comparing these premium bars with mass-market favorites like Hershey's, Snickers, and Kit Kat for their cultural significance despite lower-quality chocolate.

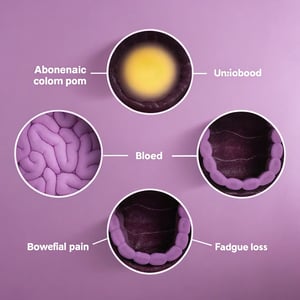

This content highlights the importance of early detection of colon cancer through recognition of symptoms such as bowel habit changes, blood in stool, and unexplained fatigue, while emphasizing regular screenings starting at age 45 and lifestyle modifications to reduce risk, including diet and exercise.

Understanding your pay stub is essential for financial management, as it details how your pay is calculated, including gross pay, deductions for taxes and benefits, and net pay, which is your actual take-home amount. Regularly reviewing your pay stub helps catch errors, aids in better tax and financial planning, and allows for more effective budgeting and contribution decisions to maximize pre-tax benefits.

The article emphasizes that breaking bad money habits involves understanding the psychological roots of spending behaviors, such as emotional triggers and ingrained money scripts, and advises combining emotional awareness with practical strategies like conducting a spending trigger audit, creating distance between impulse and action, and replacing habits instead of simply removing them. By adopting financial mindfulness, challenging negative money beliefs, practicing self-compassion, and establishing supportive systems and communities, individuals can transform their spending habits and attain long-term financial wellbeing.

Teens should master essential financial skills, such as budgeting, banking, saving, and understanding credit before age 18, to ensure smoother transitions into adulthood and prevent costly mistakes when managing money independently. Learning these skills early—from budgeting basics and the benefits of compound interest to understanding credit scores and the cost of borrowing—can set them up for long-term financial success.

Teaching kids about money at home involves using everyday activities to shape their financial habits early, starting with money recognition and simple allowance systems. Parents can implement practical lessons through activities like the three-jar money management system, digital money discussions, and age-appropriate financial games, while modeling healthy money behaviors and involving children in charitable giving, all of which lay a strong foundation for financial literacy in adulthood.

By age 30, it's crucial to understand essential financial concepts such as the distinction between assets and liabilities, the importance of tracking net worth, credit score factors, and the impact of Annual Percentage Rate (APR) on borrowing costs. Additionally, knowledge of investment terms like diversification, market cycles, and index funds, as well as retirement planning through 401(k) and IRA accounts, is vital for making prudent financial decisions. Understanding these terms supports better money management and future financial security.

Understanding credit involves recognizing that it impacts many aspects of financial life, such as interest rates and housing options, but schools often fail to teach its importance and mechanics. A credit score is based on factors like payment history and credit utilization; building a good score can be crucial for securing favorable financial terms, so individuals should proactively manage and check their credit reports while avoiding common myths about credit management.

The guide outlines effective strategies to improve credit scores quickly and sustainably in 2025, emphasizing checking for errors on credit reports, reducing credit utilization, and becoming an authorized user on a credit card. It also highlights new factors impacting scores, such as subscription payments and rent reporting, and introduces tools like Experian Boost and UltraFICO for score enhancement.

Compound interest is a powerful financial tool where you earn interest not only on your initial investment but also on accumulated interest, leading to exponential growth over time. To maximize its benefits, start investing early, reinvest earnings, and consider financial vehicles like savings accounts, CDs, dividend-paying stocks, and retirement accounts while being mindful of the compounding frequency and inflation's impact on real returns.