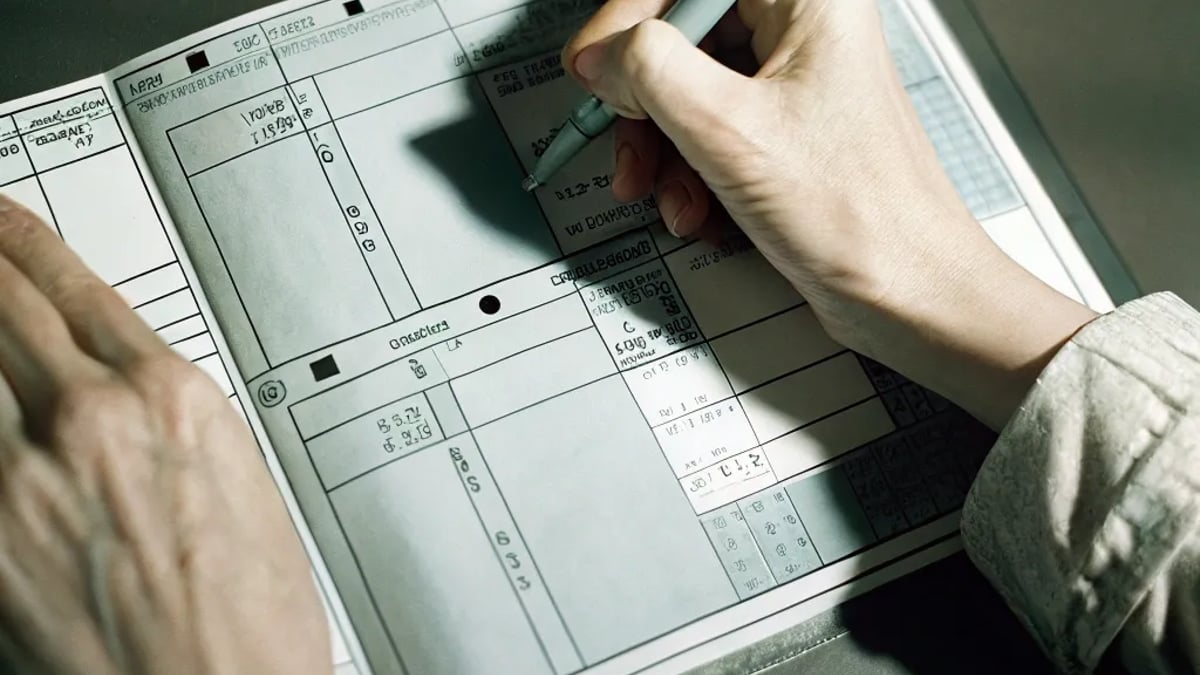

Ever glanced at your pay stub and felt like you're decoding a foreign language? You're definitely not alone. Most of us just check if the final number looks right before moving on with our day. But understanding your pay stub is actually a crucial first step in taking control of your finances.

What Exactly Is a Pay Stub?

A pay stub (sometimes called a paycheck stub or earnings statement) is the detailed breakdown that comes with your paycheck. Whether you receive it digitally or on paper, this document shows exactly how your employer calculated your pay and where your hard-earned money is going before it reaches your bank account.

"Your pay stub is essentially the story of your money—from gross pay to net pay," explains Mark Hamrick, senior economic analyst at Bankrate. "Understanding this story gives you tremendous insight into your personal finances."

Let's dive into the sections you'll typically find on your pay stub and what they mean for your wallet.

The Basic Information Section

At the top of most pay stubs, you'll find identifying information including:

- Your name and sometimes your address

- Your employee ID number

- The pay period dates (the specific days you're being paid for)

- The payment date (when the money is actually disbursed)

- Your employer's name and sometimes their address

This information might seem obvious, but it's important to verify it's correct, especially if you've recently moved or changed your name.

Breaking Down Your Earnings

The earnings section is where you'll see how much money you've actually earned during the pay period. This typically includes:

Gross Pay: Your Total Earnings

This is the full amount you earned before any deductions—your salary or hourly wages multiplied by the hours worked. If you make $20 per hour and worked 80 hours in the pay period, your gross pay would be $1,600.

Some pay stubs break this down further:

- Regular earnings: Pay for your standard hours

- Overtime earnings: Typically 1.5x your regular rate for hours worked beyond 40 in a week

- Bonus or commission payments: Additional compensation beyond your regular pay

- Reimbursements: Money paid back to you for business expenses

- Paid time off: Vacation or sick time you've used

Many pay stubs will show both your earnings for the current pay period and your year-to-date (YTD) totals, which is helpful for tracking your annual income.

Hours Worked

If you're an hourly employee, your pay stub will list the number of hours you worked during the pay period. This might be broken down into regular hours and overtime hours. Even some salaried employees might see their hours tracked for internal accounting purposes.

Where Your Money Goes: Understanding Deductions

This is where things get interesting—and sometimes confusing. The deductions section shows all the money taken out of your gross pay before it reaches your bank account.

Taxes: The Unavoidable Deductions

Several types of taxes are typically withheld from your paycheck:

- Federal income tax: Based on your earnings and the withholding information you provided on your W-4 form

- State income tax: Varies by state (some states don't have income tax)

- Local income tax: Some cities or counties collect their own income taxes

- FICA taxes: This includes Social Security (6.2% of wages) and Medicare (1.45% of wages)

"Many people don't realize that the Social Security tax has an annual wage base limit—$160,200 for 2023," notes Janet Alvarez, personal finance expert at Wise Bread. "Once you earn above that amount in a year, the 6.2% Social Security tax stops being withheld."

For higher earners, there's an additional Medicare tax of 0.9% on earnings above $200,000 ($250,000 for married couples filing jointly).

Pre-Tax Deductions: Reducing Your Taxable Income

These deductions are taken out before taxes are calculated, effectively reducing your taxable income:

- Health insurance premiums: What you contribute toward your medical, dental, or vision insurance

- Retirement contributions: Money going into a 401(k), 403(b), or similar employer-sponsored plan

- Health savings account (HSA) or flexible spending account (FSA) contributions: Tax-advantaged accounts for healthcare expenses

- Commuter benefits: Pre-tax money set aside for parking or public transportation

Pre-tax deductions are valuable because they lower your taxable income, potentially putting you in a lower tax bracket and reducing your overall tax burden.

Post-Tax Deductions: After-Tax Withholdings

These are taken out after taxes have been calculated:

- Roth 401(k) contributions: Unlike traditional 401(k) contributions, these are made with after-tax dollars

- Disability insurance: Some types of disability coverage are paid with after-tax dollars

- Wage garnishments: Court-ordered withholdings for things like child support or debt repayment

- Union dues: Fees paid to a labor union

The Bottom Line: Net Pay

After all deductions have been subtracted from your gross pay, what remains is your net pay—the actual amount deposited into your bank account or written on your check.

This simple equation sums it up: Gross Pay - All Deductions = Net Pay

According to the Bureau of Labor Statistics, the average American worker sees about 70-80% of their gross pay as net pay, though this varies widely based on income level, location, and benefit selections.

:max_bytes(150000):strip_icc()/paystub-5c6e5ab646e0fb00017dd0a4.jpg)

Additional Information You Might See

Paid Time Off (PTO) Balances

Many pay stubs include information about your accumulated vacation time, sick leave, or other paid time off. This section typically shows:

- How much time you've earned during the pay period

- How much time you've used

- Your current balance

This is helpful for planning future time off and ensuring your PTO is being tracked correctly.

Benefit Information

Some pay stubs provide details about employer contributions to your benefits, such as:

- Employer contributions to health insurance

- Matching funds for retirement accounts

- Contributions to HSAs or similar accounts

This information reminds you of the total compensation you're receiving beyond just your salary or wages.

Why Should I Care About My Pay Stub?

Understanding your pay stub isn't just about satisfying curiosity—it has practical benefits:

1. Catching Errors

Mistakes happen. Maybe you worked overtime that wasn't accounted for, or perhaps too much was withheld for health insurance. Reviewing your pay stub regularly helps you catch these errors early.

"I once had a client who discovered they'd been paying for family dental coverage for three years after their divorce, when they only needed individual coverage," shares financial planner Rebecca Walser. "That simple pay stub review saved them over $1,200 annually going forward."

2. Better Tax Planning

Understanding your withholdings can help you adjust your W-4 form if needed. If you consistently get large tax refunds, you might be withholding too much throughout the year—essentially giving the government an interest-free loan. Conversely, if you often owe taxes, you might need to increase your withholding.

3. Maximizing Pre-Tax Benefits

Seeing exactly how much you're contributing to retirement accounts or health savings accounts can motivate you to increase these contributions, potentially saving thousands in taxes over time.

4. Budgeting Accurately

When you understand exactly where your money goes before it reaches your bank account, you can budget more effectively based on your actual take-home pay rather than your nominal salary.

How Do I Actually Read My Pay Stub?

Let's walk through a practical example of reading a pay stub. While formats vary by employer, most contain similar information.

Case Study: Reading Sarah's Pay Stub

Sarah is a marketing coordinator making $60,000 annually, paid bi-weekly. Her recent pay stub shows:

Gross Pay (Current): $2,307.69

- This represents her annual salary divided by 26 pay periods ($60,000 ÷ 26)

Deductions (Current):

- Federal Income Tax: $277.00

- Social Security Tax: $143.08 (6.2% of gross pay)

- Medicare Tax: $33.46 (1.45% of gross pay)

- State Income Tax: $115.38

- Health Insurance: $125.00 (pre-tax)

- 401(k) Contribution: $230.77 (10% of gross pay, pre-tax)

- Dental Insurance: $15.00 (pre-tax)

- Vision Insurance: $5.00 (pre-tax)

- Long-term Disability Insurance: $11.54 (post-tax)

Net Pay (Current): $1,351.46

By reviewing this information, Sarah can see that:

- Her effective tax rate is about 24.7% (combining all taxes)

- She's saving 10% of her income for retirement

- Her benefits cost about 6.7% of her gross pay

- Her take-home pay is approximately 58.6% of her gross pay

This knowledge helps Sarah budget accurately and consider whether she wants to adjust any of her withholdings or contributions.

Common Questions About Pay Stubs

Why is my net pay so much less than my gross pay?

Between taxes and various deductions, it's normal for your net pay to be 20-30% (or more) less than your gross pay. The exact percentage depends on your income level, tax situation, and what benefits you've elected.

What should I do if I find an error on my pay stub?

Contact your company's payroll or HR department immediately. Most errors can be corrected in the next pay period, but the sooner you report them, the better.

How long should I keep my pay stubs?

It's a good idea to keep your pay stubs for at least a year, or until you receive your W-2 form and verify that the information matches. Some financial experts recommend keeping your final pay stub of the year for longer, as it shows your annual totals.

"In today's digital world, many employers offer electronic pay stubs that you can access indefinitely," notes Tom Totten, CEO of Nyhart, an actuarial and employee benefits firm. "If that's the case, you may not need to save physical copies."

Can I change how much tax is withheld from my paycheck?

Yes, by submitting a new W-4 form to your employer. If you consistently receive large tax refunds or owe significant amounts at tax time, adjusting your withholding might be appropriate.

Taking Control of Your Financial Future

Understanding your pay stub is just the first step in managing your personal finances effectively. Once you know where your money is going, you can make more informed decisions about:

- How much to contribute to retirement accounts

- Which health insurance option is most cost-effective for your situation

- Whether you're withholding the right amount for taxes

- How to budget based on your actual take-home pay

"Financial literacy starts with understanding what happens to your money from the moment it's earned," says Tiffany Aliche, founder of The Budgetnista. "Your pay stub is essentially the first chapter in your financial story."

By taking the time to decode your pay stub, you're empowering yourself to write a better financial future—one paycheck at a time.

Disclaimer: This content is provided for informational purposes only and should not be considered financial advice. Tax laws and payroll practices vary by location and employer. Consult with a financial professional for advice specific to your situation.

References and Additional Resources

Tags

About Evan L. Chamberlain the Author

Evan L. Chamberlain is a seasoned personal-finance strategist with over 15 years of experience in helping individuals maximize their savings and efficiently manage debt. His approachable insights on budgeting and investment have empowered thousands to take control of their financial futures.

Recommended Articles

Over 60? This Bedtime Stretch Routine May Ease Stiff Joints

This bedtime stretch routine helps ease stiff joints for seniors, promoting flexibility and better sleep for a healthier lifestyle.

The Truth About Housing Assistance for Single Mothers

Discover essential housing assistance options for single mothers, debt solutions, and community resources to secure stable living arrangements.

Chevrolet Unveils The 2026 Silverado 1500S Bold Evolution

Discover the bold evolution of the 2026 Chevrolet Silverado 1500S with advanced features, powerful engines, and innovative technology.

A Look at Research on This Common Kitchen Spice

Explore the health benefits of turmeric, its anti-inflammatory properties, and potential applications in cancer therapy and epilepsy management.

Overview of Polymyalgia Rheumatica and Its Treatment Options

Explore Polymyalgia Rheumatica: symptoms, diagnosis, and effective treatment options including corticosteroids and lifestyle changes for better living.