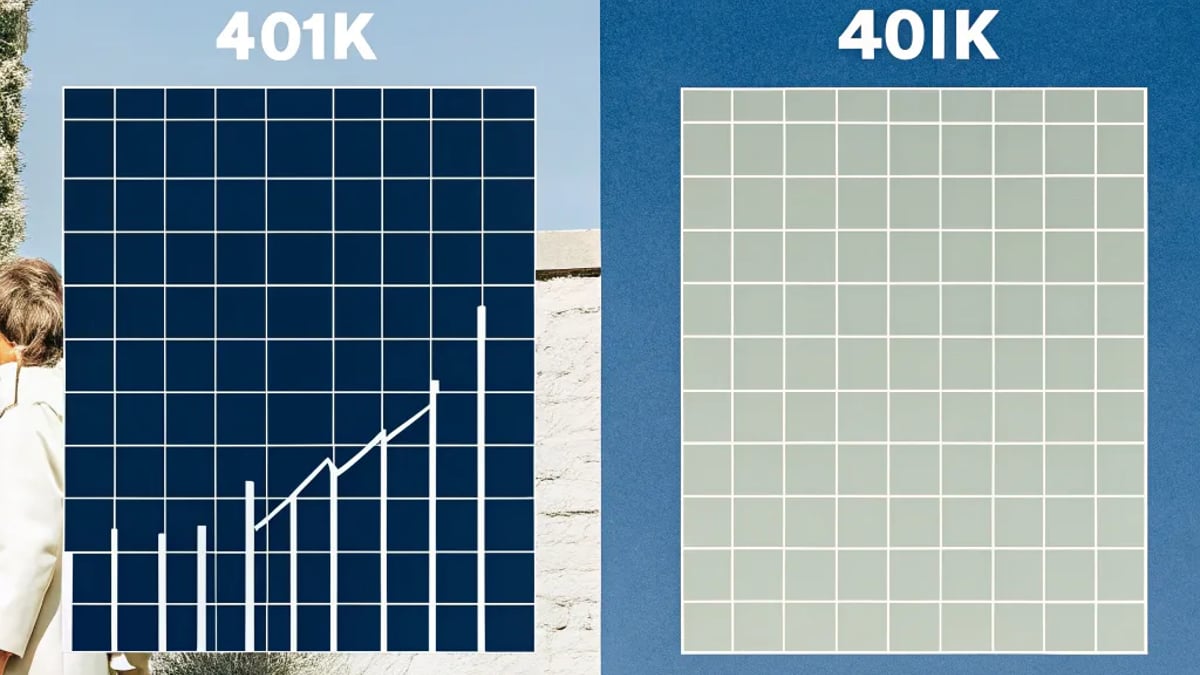

When mapping out your retirement strategy, deciding between a 401(k) and a Roth IRA often feels like standing at a financial crossroads. Last week, a colleague asked me this exact question over coffee, and I realized how common this dilemma is. Both accounts offer unique advantages, but most of us have limited funds to contribute. So which retirement account deserves your hard-earned dollars first?

Understanding the Basics: 401(k) and Roth IRA

Before diving into which account to prioritize, let's clarify what each one brings to the table.

401(k) Plans: Employer-Sponsored Advantages

A 401(k) is an employer-sponsored retirement plan that allows you to contribute pre-tax dollars from your paycheck. These contributions reduce your current taxable income, potentially placing you in a lower tax bracket today. The money grows tax-deferred until retirement, when withdrawals are taxed as ordinary income.

Key features of a 401(k) include:

- Higher contribution limits: In 2023, you can contribute up to $22,500 annually ($30,000 if you're 50 or older).

- Employer matching: Many companies match a percentage of your contributions—essentially offering free money toward your retirement.

- Automatic payroll deductions: Contributions come directly from your paycheck, making saving effortless.

- Loan provisions: Some plans allow you to borrow against your balance (though this comes with significant drawbacks).

Roth IRA: Tax-Free Growth Potential

A Roth IRA works differently. You fund it with after-tax dollars, meaning you pay taxes on the money before it goes into the account. The major benefit? Qualified withdrawals in retirement are completely tax-free, including all the growth your investments have earned.

Roth IRA highlights include:

- Tax-free withdrawals: Once you reach 59½ and the account has been open for at least five years, withdrawals are tax-free.

- No required minimum distributions (RMDs): Unlike traditional retirement accounts, Roth IRAs don't force you to take distributions during your lifetime.

- More flexible early access: You can withdraw your contributions (but not earnings) at any time without penalties.

- Income limits: Higher earners may be restricted from direct Roth IRA contributions (though "backdoor" strategies exist).

The Case for Maxing Out Your 401(k) First

There are compelling reasons why prioritizing your 401(k) might make sense:

1. Don't Leave Free Money on the Table

The most persuasive argument for prioritizing your 401(k) is the employer match. According to a Vanguard study, the average company match is around 4.5% of salary. This is essentially a 100% return on your investment before considering any market growth.

"The employer match is the closest thing to free money you'll ever find in the investment world," says Christine Benz, director of personal finance at Morningstar. "It's an immediate return on your money that's hard to beat elsewhere."

2. Higher Contribution Limits

If you're aiming to save aggressively for retirement, the substantially higher contribution limits of a 401(k) allow you to shelter more money from current taxation. This is particularly valuable for high-income earners or those playing catch-up on retirement savings.

3. Simplicity and Automation

The automatic nature of 401(k) contributions makes them psychologically easier to maintain. The money never touches your checking account, removing the temptation to spend it elsewhere. This "set it and forget it" approach often results in higher savings rates over time.

The Case for Prioritizing Your Roth IRA

Despite the 401(k)'s advantages, there are several situations where maxing out a Roth IRA first might be the smarter move:

1. Tax Diversification Benefits

One of the biggest unknowns in retirement planning is your future tax rate. By contributing to a Roth IRA, you're essentially locking in your current tax rate and protecting yourself against potentially higher rates in retirement.

"Tax diversification is crucial," notes financial planner Michael Kitces in his financial planning blog. "Having different buckets of money with different tax treatments gives you flexibility to manage your tax situation in retirement."

2. Superior Investment Options

Many 401(k) plans offer a limited menu of investment options, often with higher fees than you might find elsewhere. Roth IRAs, by contrast, can be opened at virtually any brokerage firm, giving you access to thousands of investment options, often with lower expense ratios.

According to a 2022 study by the Investment Company Institute, the average expense ratio for 401(k) investments was 0.41%, while many index funds and ETFs available to Roth IRA investors charge less than 0.10%.

3. Flexibility for Early Access

Life doesn't always go according to plan. The ability to access Roth IRA contributions penalty-free before retirement provides a financial safety valve that 401(k)s don't offer. This can be particularly valuable for younger investors who might need funds for a home purchase or other major life events.

What Should You Do First? A Strategic Approach

Rather than viewing this as an either/or decision, consider this tiered approach:

- Contribute enough to your 401(k) to get the full employer match. This ensures you don't leave free money on the table.

- Max out your Roth IRA (if eligible). In 2023, that's $6,500 ($7,500 if you're 50 or older).

- Return to your 401(k) and contribute up to the annual limit if you still have funds available for retirement savings.

- Consider additional options like HSAs, backdoor Roth contributions, or taxable brokerage accounts if you've maxed out both accounts.

This approach combines the best features of both account types—you get the employer match and tax deduction from the 401(k) while also building tax-free growth potential with the Roth IRA.

When Should You Break This Rule?

The standard advice doesn't fit everyone. Here are situations where you might prioritize differently:

When to Prioritize 401(k) Beyond the Match

- You're in a high tax bracket now but expect to be in a lower bracket in retirement

- You're close to retirement and need to maximize tax-deferred savings

- Your 401(k) offers exceptional investment options with very low fees

- You want to protect assets from creditors (401(k)s typically have stronger legal protections)

When to Prioritize Roth IRA Completely

- You're early in your career with relatively low income (and low tax rates)

- Your employer offers no match or a very low match

- Your 401(k) has poor investment options with high fees

- You value flexibility and might need access to contributions before retirement

How Does Your Age Factor In?

Your age and career stage significantly impact this decision:

For younger investors (20s-30s), Roth accounts often make more sense. You're likely in a lower tax bracket now than you will be later in your career, making the current tax hit less painful. Plus, decades of tax-free growth can be incredibly valuable.

Mid-career professionals (40s-50s) might benefit more from the immediate tax deduction of traditional 401(k) contributions, especially during peak earning years when tax deductions are most valuable.

What About Tax Rates?

Current tax rates are historically low following the Tax Cuts and Jobs Act of 2017, but these rates are scheduled to sunset after 2025. This potential for higher future tax rates strengthens the case for Roth contributions now.

However, predicting future tax policy is impossible. That's why tax diversification—having both pre-tax and Roth assets—is so valuable. It gives you options regardless of which way tax rates move.

Should You Consider Your 401(k)'s Investment Quality?

The quality of your 401(k) plan should influence your decision. If your plan offers a limited selection of high-fee funds, you might want to contribute only enough to get the match, then focus on your Roth IRA where you can choose lower-cost investments.

According to research from America's Best 401k, the difference between a 401(k) charging 1% in fees versus one charging 0.25% can amount to hundreds of thousands of dollars over a 40-year career.

Why Not Both? The Case for Simultaneous Contributions

I've been splitting my retirement contributions between both accounts for years now. If you can afford it, contributing to both a 401(k) and a Roth IRA simultaneously creates valuable tax diversification.

Some investors even use a "strategic conversion ladder" approach—contributing to a traditional 401(k) during high-income years, then converting portions to Roth accounts during lower-income periods to manage their tax liability.

The Bottom Line: Make an Informed Choice

The "right" choice between a 401(k) and Roth IRA depends on your unique financial situation, including:

- Your current and expected future tax brackets

- Whether your employer offers a match

- The quality of investment options in your 401(k)

- Your need for flexibility and access to funds

- Your overall retirement timeline

Remember that the perfect can be the enemy of the good. The most important step is to start saving consistently in either account rather than delaying while trying to optimize every detail.

Disclaimer: This information is provided for educational purposes only and should not be considered financial advice. Everyone's situation is unique, and you should consult with a qualified financial professional before making investment decisions.

Tags

About Elliot W. Ramsey the Author

Elliot W. Ramsey is a financial-literacy expert with over 15 years of experience empowering individuals to cultivate healthy financial habits and manage personal budgets. He is renowned for his ability to simplify complex financial concepts, making them accessible to audiences of all ages.

Recommended Articles

7 Old Gaming Gadgets That Are Worth More Than Ever

Explore seven old gaming gadgets that are now valued higher than ever and understand what makes them collectible treasures.

How Social Security’s January Catch-Up Payments Work

Learn how Social Security's January Catch-Up Payments work and how they can boost your retirement income effectively.

Check Which Costly Medications Are Getting Medicare Price Reductions Soon

Discover which medications will see Medicare price reductions starting in 2026, easing financial burdens for seniors relying on prescription drugs.

Who Gets the Social Security Catch-Up Payment Coming in January

Discover who qualifies for the Social Security Catch-Up Payment coming in January and how it provides vital support for seniors.

Retirees Share Simple Grocery Habits That Cut Costs

Discover simple grocery habits retirees can use to save money while enjoying healthy meals. Budget wisely and shop smarter with these tips!